Double-Irish-Dutch Sandwich

Ingredients

Make sure you have the following on hand:

- Buns

- Guinness-Mustard

- Dutch cheese, “belegen”

- A Knife

- A Good Lawyer

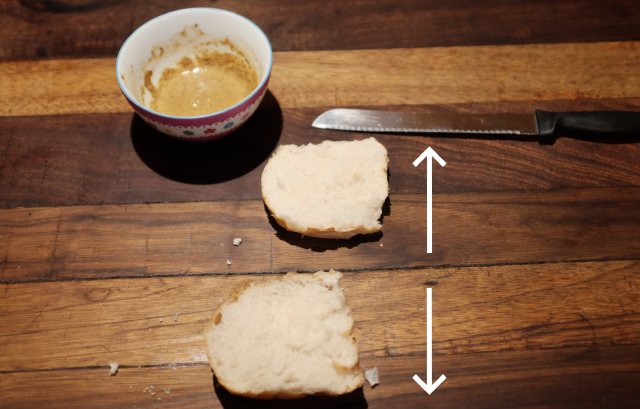

Step One

Carefully split your US company up into multiple international subsidiaries. Two of those are based in Ireland. These two Irish subsidiaries we call Irish1 and Irish2. For US tax purposes, Irish1 and Irish2 are considered one entity, thus transactions between the two are not taxed.

Step Two

Irish1 is managed by a parent company in Bermuda or another offshore tax haven. For Irish tax law, this makes Irish1 a foreign company owning an Irish company. Irish tax law sees transactions between the two as royalties, costs which are deductible from the revenue before earnings are taxed.

Irish2 is 100% owned by Irish1. Additionally, Irish1 has another subsidiary in the Netherlands called Dutch1. Irish1 owns all the intellectual property of the company but licenses that to Dutch1.

Step Three

All the companies revenues are made by Irish2. However, it needs to pay royalties for the IP to Dutch1. Apply the royalties generously and in a smooth motion. That way, the earnings of Irish2 barely outweigh the royalties that are paid to Dutch1, so only a small percentage of the earnings is taxed as profit (the other part is exempted as deductible trade costs).

Step Four

Add the main ingredient, Dutch1, which in turn must also pay royalties to Irish1. Again, only the revenue minus the costs are taxed. What makes the main ingredient special is that the Dutch make tax treaties for payments to foreign companies. Generally, the taxes paid via these treaties are much lower than domestic taxes.

Step Five

Further increase your tax efficiency by applying more Guinness-Mustard in the form of an EU directive. That EU directive stipulates no withholding taxes are to be levied when Dutch1 pays royalties to Irish1. Irish1 then transfers the earnings to Bermuda.

Step Six

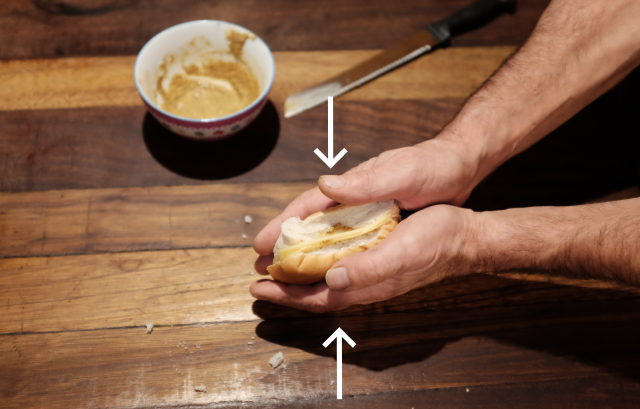

Bring everything together in Bermuda, where no income tax is paid. Again, the transactions between all the subsidiaries are considered internal by US law and are thus not taxed by the US. Only when parts of the earnings are transferred to the US parent company, a US corporate tax is paid.

Step Seven

Enjoy your super simple and legal Double-Irish-Dutch Sandwich.

After the Infrastructours made its way back to Sign gallery everyone was hungry. Luckily, the hungry participants were awaited by a long table with lots of ingredients and instructions on how to make their own Double-Irish-Dutch Sandwiches!